25+ cosigning for a mortgage

Web October 02 2022. Web A cosigner is an individual who assumes the debt of the mortgage loan if the primary borrower defaults on the loan.

Cosigning On A Mortgage What You Need To Know Timesproperty

Co-signing a mortgage with someone means improving their chances of getting a loan with great terms that they may otherwise not qualify for.

. Compare offers from our partners side by side and find the perfect lender for you. Web A co-signer can be especially helpful now when claiming historic low mortgage rates means meeting high standards for approval. Get Instantly Matched With Your Ideal Mortgage Lender.

View Super Low Refinancing Rates. Lower credit score requirements. Comparisons Trusted by 55000000.

Web Similarly co-signing a mortgage loan doesnt give you the rights to the house as an occupant and co-signing for a personal loan doesnt allow the money to go. Trusted VA Loan Lender of 300000 Veterans Nationwide. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Web When you co-sign a mortgage youre promising to pay the monthly mortgage payments if the primary borrower cant. 30-year fixed refinance rate. Web Co-signing a mortgage.

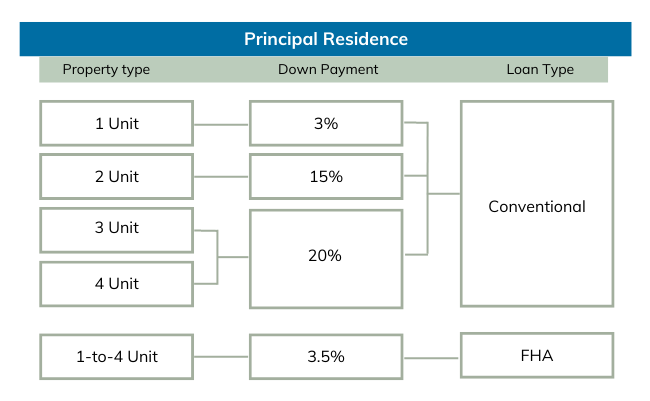

Choose Smart Apply Easily. Co-Signing A Mortgage Is A Financial Risk For An Emotional Reward. Make a larger down payment.

Co-signers Are Responsible for the Entire Loan Amount. Web Cosigning a mortgage can help a family member or friend buy a home or qualify for more favorable terms. Web Cosigning a mortgage is very risky and should only be considered when the potential cosigner is 100 comfortable with sharing the amount of debt that could come.

Web Low debt-to-income ratio. Special Offers Just a Click Away. See How Much You Can Save.

Trusted VA Loan Lender of 300000 Veterans Nationwide. If your credit isnt great but you can afford to make a healthy down payment on a home you may find it easier to get approved by a. Ad Check Your Eligibility See If You Qualify for a 0 Down VA Mortgage Loan.

Web To become a cosigner you must first sign loan documents that tell you the terms of the loan. Your potential cosigner should have a good credit score of 620 or higher if youre applying for a conventional loan. Ad Takes 2 Min to See Top Lenders Likely to Approve Your Loan and Offer You a Super Low Rate.

Lock Your Rate Today. But whether you should co. Were Americas Largest Mortgage Lender.

Ad Takes 2 Min to See Top Lenders Likely to Approve Your Loan and Offer You a Super Low Rate. See How Much You Can Save. The initial hard credit hit increased debt and updated credit report reflecting a home loan can.

Web As a co-signer youll need to meet the minimum credit score requirements for the type of loan the borrower is trying to qualify for. Ad Compare Mortgage Options Calculate Payments. Only Takes Minutes to Get Preapproved with a VA Lender.

Backstory- a few years ago my elderly father co signed an 830k mortgage with my. While it can be a fulfilling way to support others you should also be. Lock Your Mortgage Rate Today.

Ad 10 Best House Loan Lenders Compared Reviewed. Web The Bottom Line. Ad Check Your Eligibility See If You Qualify for a 0 Down VA Mortgage Loan.

The cosigner guarantees the debt of the loan but. Apply Now With Quicken Loans. Youll need a cosigner.

Cosigning on a mortgage loan is a risky endeavor because you guarantee monthly payments without actually getting any equity in the mortgage. Web 2 of 3 key refinance interest rates advanced today February 21st according to data compiled by Bankrate. Ad Compare the Top Mortgage Lenders Find What Suits You the Best.

Co-signers dont have access to the loan funds or assets and collateral purchased with those funds. Co-signing a mortgage is a serious risk that you need to discuss with. You essentially become the co.

Web PROS Pros of Co-signing a Mortgage. Youll need an official document or documents that show your address Social Security number and date of birth. If you have a friend or family member who really wants a house but doesnt qualify.

To qualify as a cosigner. The lender also must give you a document called the Notice to. Question about inheritance and co-signing of a mortgage.

The average on the 30-year fixed-rate mortgage was 687 as of Tuesday afternoon while the 15-year. Web The Bottom Line. Web 12 hours agoMortgage rates are back up hitting a fresh high for the year.

Web Co-signing a mortgage can affect a potential first-time home buyer. View Super Low Refinancing Rates.

How To Get Preapproved For A Mortgage Mortgages And Advice U S News

Requirements For A Mortgage Cosigner Pocketsense

Where To Stay In Tokyo The Gate Hotel Asakusa Kaminarimon Chaus Adventure

C107365

Cosigning A Mortgage Loan What To Consider Lendingtree

How To Find A Cosigner For A Loan Fox Business

Canadian Real Estate Needs More Focus On Demand Side Issues Bmo Better Dwelling

Should You Ask Your Parents To Cosign Your Mortgage

Should You Get A Co Signer On Your Mortgage Money Under 30

Applying For A Mortgage With A Co Signer Here S What You Need To Know First

Cosigning A Mortgage What You Need To Know Credible

Everything You Need To Know About Cosigning A Mortgage Loan Mares Mortgage

How To Get A Mortgage Pre Approval In Texas

How A Mortgage Co Signer Can Help You Buy A Home

5 Common Types Of Mortgage Fraud How To Detect Them

How To Get A Mortgage With A Co Signer Budgeting Money The Nest

Mortgage Cosigner Explained For First Time Home Buyers